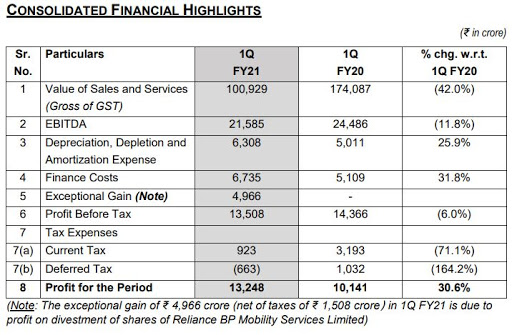

thanks to a major 54 per cent YoY growth in other income at Rs 4,388 crore.The company booked a one-time gain of Rs 4,966 crore on an investment by British oil major BP in its fuel marketing business -- Reliance BP Mobility Services.

Analysts in an ET Now poll had projected the profit figure at Rs 7,700 crore.The company also managed to bring down total expenditure by about 42 per cent YoY to Rs 87,406 crore from Rs 1,50,858 crore in Q1FY20.

At the same time, consolidated total income fell 42 per cent YoY to Rs 95,626 crore. The company said the group’s operations and revenues for the quarter were impacted by the Covid-19 disruption.

Consolidated Ebitda declined 11.80 per cent YoY to Rs 21,585 crore agaist Rs 24,486 crore reported for the same period last year.“The severe demand destruction due to global lockdowns impacted our hydrocarbons business, but the flexibility in our operations enabled us to operate at near-normal levels and deliver industry-leading results,” Chairman and Managing Director Mukesh Ambani said in the earnings release.

Reliance Jio profit zooms 182%

Telecom arm Reliance Jio Infocomm reported 182.82 per cent YoY growth in net profit at Rs 2,520 crore for the quarter against Rs 891 crore reported for the same period last year.

Jio’s revenue from operations jumped 33.70 per cent to Rs 16,557 crore while Ebitda grew 55.40 per cent to Rs 7,281 crore. It reported an Arpu of Rs 140.30 for the quarter against Rs 130.6 in March quarter. Its biggest rival Bharti Airtel NSE -2.38 % reported an Arpu of Rs 157 for the quarter against Rs 129 for the year-ago period, thanks to the full impact of the tariff hikes in the previous quarter.

Reliance Retail, however, witnessed a 17.20 per cent YoY fall in revenue at Rs 31,633 crore. EBITDA declined 47.40 per cent YoY to Rs 1,083 crore.

The company, however, said Reliance Retail’s Ebitda was positive and resilient despite the limitations of the quarter, and cost management initiatives led to savings on fixed cost, which in turn helped cushion the impact of lower profits from lower sales.

Revenues from the petrochemicals business declined 33 per cent YoY to Rs 25,192 crore, primarily due to lower price realisations due to the Covid-19 disruptions in local and regional markets. The segment’s Ebitda declined 49.7 per cent YoY to Rs 4,430 crore.

“Weak domestic demand and higher share of exports impacted margins compared with regional benchmarks. The impact of lower realisation was partially offset by cost optimisation and integration benefits,” RIL said.